First time buyer mortgage bad credit history

Often the answer to the question Should I buy a home or a car first is out of necessity its easier and faster to save the down payment on a 20000 purchase. Best bad credit mortgage rates.

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2022 Badcredit Org

You must be 18 or older a US.

. Credit cards for bad credit Cashback cards Rewards cards Use abroad cards Money transfer cards Loans. The average first-time home buyer is 34 years old. Looking for the best first-time buyer mortgage should be at the top of your list.

First-time home buyers typically finance 93 percent of their home while repeat buyers finance 84 percent. Call us today on 01925 906 210 or complete our quick and easy First Time Buyer Mortgage Application. If youre a VA borrower or refinancing a VA mortgage Guaranteed Rate waives all loan fees.

First-Time Home Buyers Tax Credit. RRSP Home Buyers Plan. First-Time Home Buyer Grants.

Federal Housing Administration FHA Loans. The pawn dealer. While this is a benefit for many people recent changes in policy may have put the loans just out of reach for some would-be homeowners with questionable credit history.

Popular Articles How to buy a house with 0 down in 2022. This can be helpful for first-time borrowers who might not have an established credit history. The homes value will help the mortgage lender determine the amount you can borrow notwithstanding your lack of credit history.

First-Time Home Buyer Programs. FHA loans provide great assistance to many first-time homebuyers by offering mortgage loans with lower down payments. Bad Credit SIM Only Deals 30 Day SIM Deals Pay As You Go SIM Deals.

Find a great deal today. Mortgage insurance also known as mortgage guarantee and home-loan insurance is an insurance policy which compensates lenders or investors in mortgage-backed securities for losses due to the default of a mortgage loanMortgage insurance can be either public or private depending upon the insurer. The policy is also known as a mortgage indemnity guarantee.

First-Time Home Buyer Loans. First-time home buyer mortgage facts. In practice however a 20 down payment is too hefty for most borrowers.

This bill would bring back the tax credit from 2008 with many of the same requirements. Purchasing a home may be unattainable as a first-time buyer on an entry-level salary. Its often worth waiting until youve built up your credit history to apply for a first-time buyer mortgage.

The option of a low down payment and more lenient credit requirements can make FHA loans particularly attractive for first-time home buyers although you dont have to be a first-time home buyer in order to qualify. Citizen or permanent resident and the owner of a checking account to complete the online form on the website. The First-Time Homebuyer Act of 2021 was introduced by several Democratic members of Congress in April 2021.

Here are some benefits of FHA loans. The First-Time Home Buyer Incentive is a shared-equity mortgage with the Government of Canada which offers. The most in.

5 or 10 for a first-time buyers purchase of a newly constructed home. FHA loans are a good option for first-time buyers with poor credit or anyone who doesnt have 20 to put toward a down payment. But the average house deposit for a first time buyer in the UK is around 15.

You will also need strong rent prospects and a healthy credit history. A mortgage may represent your first use of credit. Credit score requirements are lower compared to other loans.

In 2020 there were 238 million first-time home buyers. Meanwhile those who bought houses for the first time only made a 7 down payment whereas repeat buyers paid 16 down. The property you hock does all the talking.

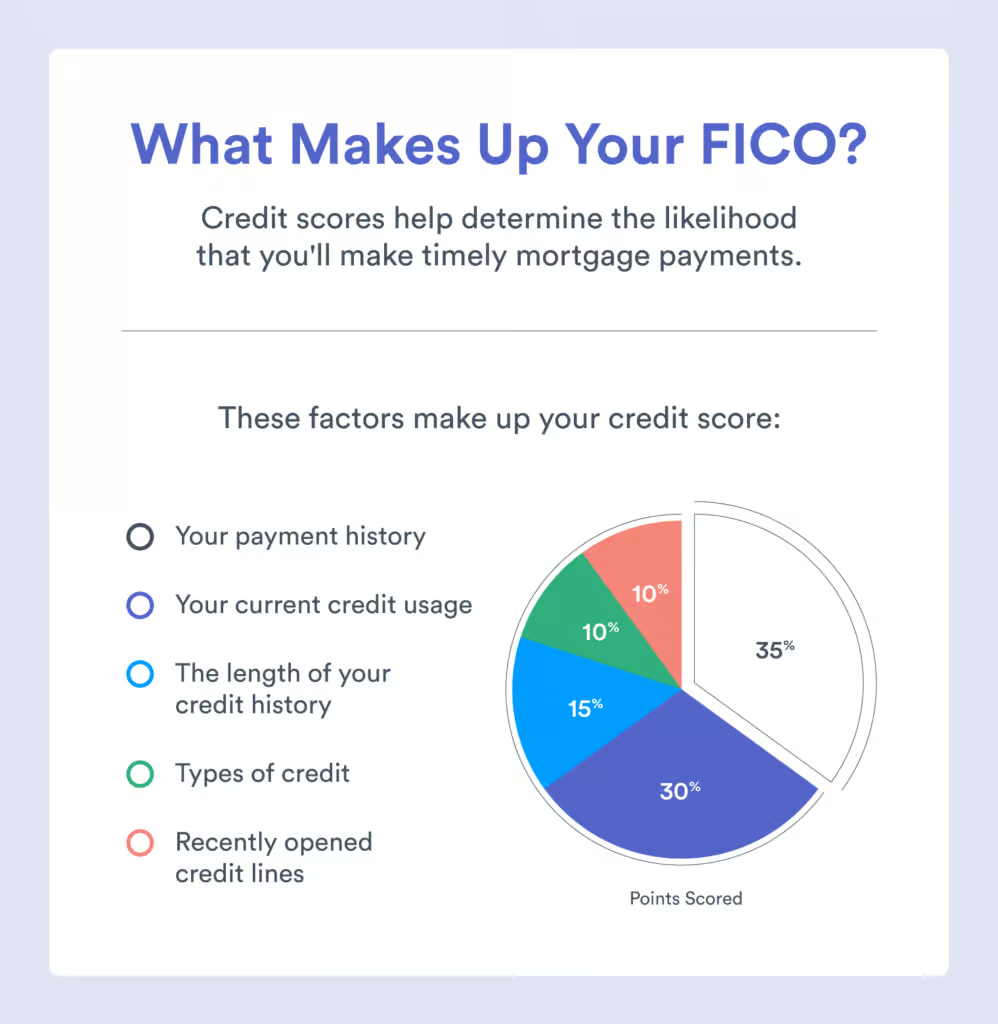

Payment history 35 of credit score Length of credit history 15 of credit score. Good Credit History Makes it Easier to Qualify. Land Transfer Tax Rebate.

The comparison tool doesnt take into account your financial situation or your credit history so its still important to. If youre a first-time buyer earning less than 80000 a year or 90000 in London you could be eligible for a shared ownership mortgage with which you buy a percentage of a property say 25 - and pay rent on the rest. Consulting with a mortgage loan officer is free and will help you determine which bad credit mortgage program is best for you.

With a first-time buyer mortgage youre likely to be looking for a 90 or 95 mortgage deal meaning youll need a 5 or 10 deposit saved. Many first-time homebuyer programs grants and down payment assistance programs are available to help you secure the financing you need to purchase your first home. PST On CMHC Insurance.

Credit reporting agency Experian reported that the average down payment for homebuyers in 2018 was 13. If you dont. The First-Time Home Buyer Incentive helps qualified first-time homebuyers reduce their monthly mortgage payments without adding to their financial burdens.

Most mainstream lenders are reluctant to loan to those with bad credit as their poor credit history doesnt provide the assurance they need that the loan will be paid back. Experian 2020 31 percent of buyers in 2021 were first-time home buyers. These loans depend on your paycheck not your credit history.

How To Get A Mortgage With Bad Credit Credit Com

How To Buy A House With Bad Credit Improve Your Credit Credit Org

How To Buy A House With Bad Credit In 2022 Tips And Tricks

Buying A New Car When You Have Bad Credit Edmunds

How To Get A Bad Credit Home Loan Lendingtree

Can You Buy A House With No Credit Credible

What Is A Good Credit Score To Buy A House Or Refinance

What Credit Score Do You Need To Buy A House In 2022

How To Buy A House With Bad Credit Nerdwallet

Minimum Credit Scores For Fha Loans

5 Steps To Get A Loan As A First Time Home Buyer With Bad Credit Badcredit Org

Best Low Down Payment Mortgages For First Time Buyers

How To Buy A House With Bad Credit A Guide For First Time Home Buyers

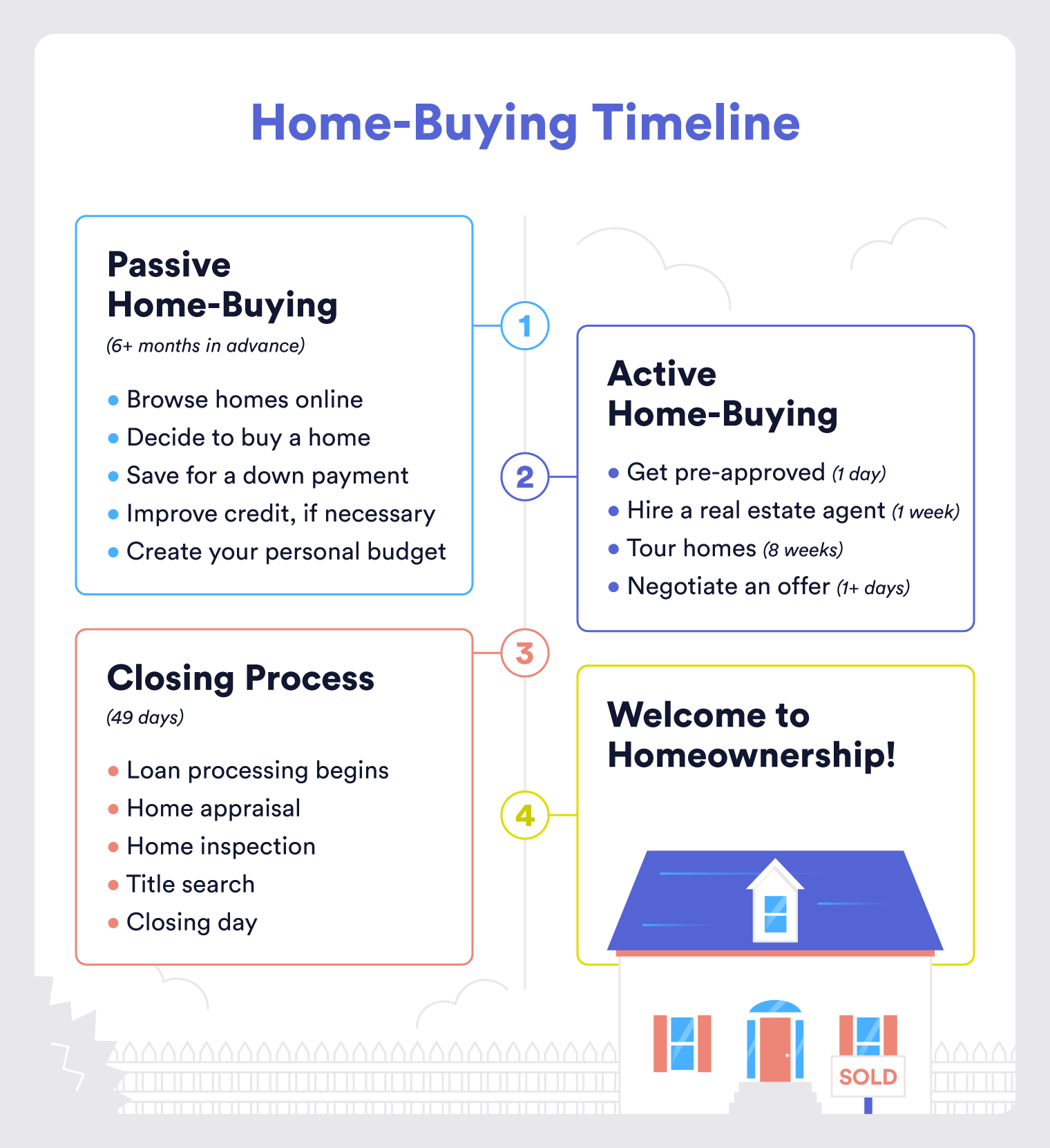

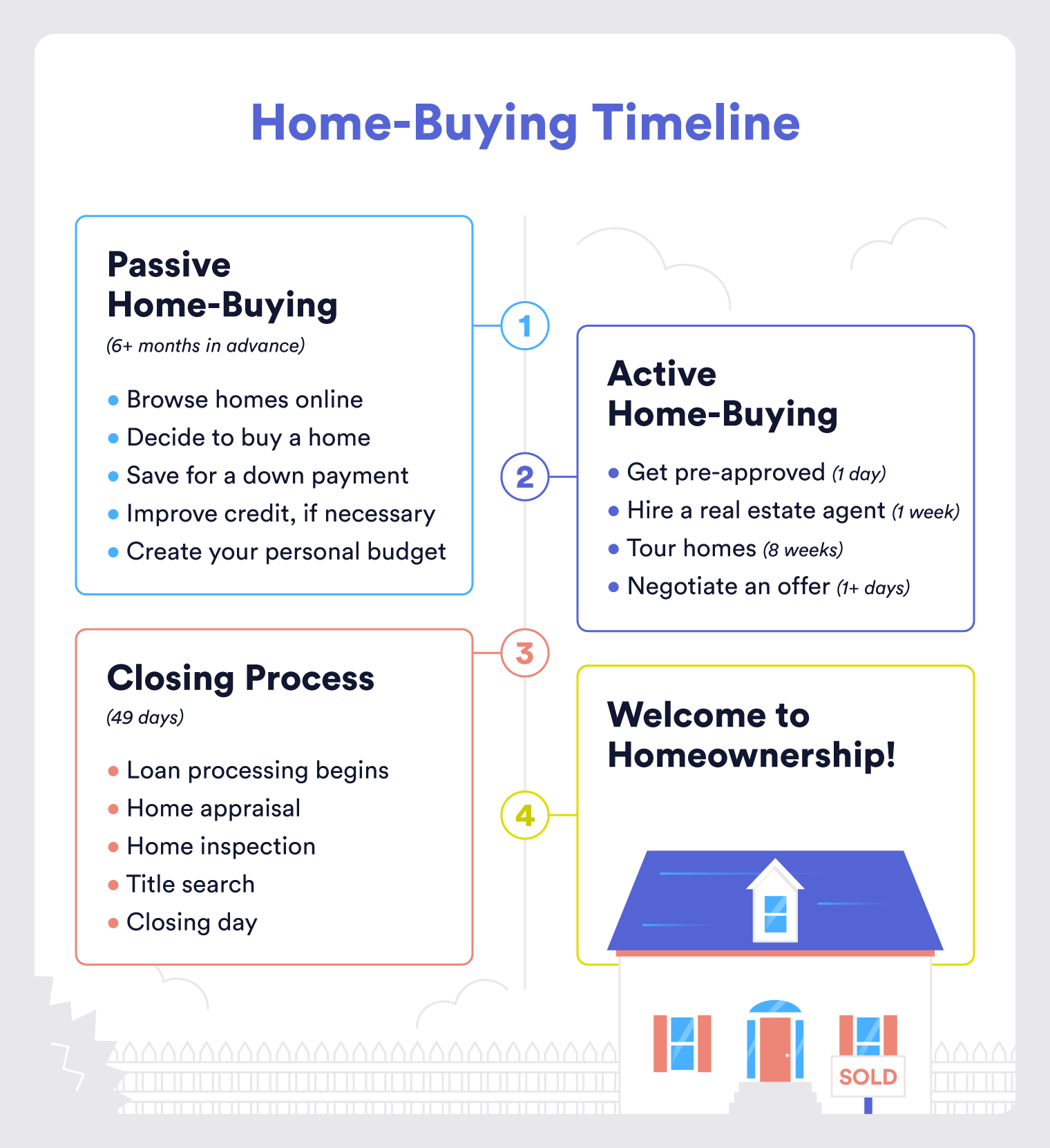

A Simple Home Buying Timeline For First Time Buyers

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Buy A House With Bad Credit Nerdwallet

How To Get A Home Loan With Bad Credit In New York Propertynest